Challenges Faced by the Banking Sector

With rapid changes in how technology works, every industry and sector of the world is moving forward with adoption of innovative technology. The banking sector is rapidly growing and needs better ways to cater to the needs of its customers. This has erected barriers for the banking sector with challenges to growth that it faces every day.

- Regulation: The handsome amount of data banks have to deal with every day brings with itself regulatory concerns. Many complexities and limitations are put in place for the banking sector. The data banks use every day needs to be regulated to avoid errors as the errors can result in massive losses. Manual handling of the work puts enormous pressure on the workers.

- Legal Challenges: With the world now a big integrated ball globally, nothing can be hidden. Legal issues have increased and requirements have been put in place to avoid any misuse of data. Banks have to maintain records and produce them when required, hence putting the added pressure of keeping the data for undefined periods of time.

- Privacy and Security: The growing trends of online banking have changed the needs of customers who now ask for utmost privacy in all their dealings. Banks are required to maintain records of users in the most secure way. Customers also only choose a bank when they are sure that their record will only be used by them.

- Greater Users: With more and more users entering the banking sector daily, greater pressure is put on banks to accommodate to the growing users. Banks are in need of greater space to store the data of their ever increasing users.

Need for Disaster Recovery and Business Continuity

Apart from these four challenges which the banking sector faces due to the evolving world, the biggest challenge faced by the banking sector is the lack of strategized ‘Disaster Recovery and Business Continuity’.

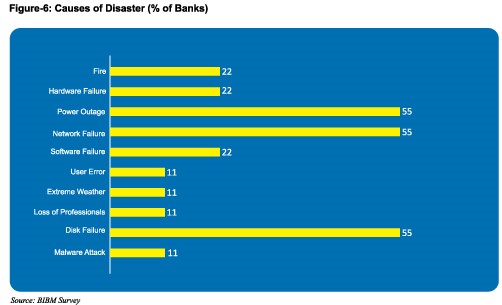

With more and more data being used, the probability of data failing is also increasing. The failure can be due to any reason ranging from hardware failure to malware attack. Completely stopping the failures is still an alien concept. The solution of such failures lies in how to deal with the failures once they occur.

This is done through backup and disaster recovery. The restoration of operations after disaster strikes is the most important task of any bank. The disaster can be in any form but mostly is in the form of power outages, network failures and disk failures.

The concern of the banks is not about the disaster which has struck, they are focused on getting the work up and running again with minimal loss of time. Banks are hence looking for solutions which provide them with speedy access to work after a disaster strikes.

Business continuity holds utmost importance in all segments of the economy. So is the case with the banking sector which is looking for solutions which ensure business continuity. Banks have realized the need to keep their operations always up and working so that to reap maximum benefits from their work.

StoneFly: Providing Storage to Banks; Economy Growing to Unmatchable Ranks

StoneFly has taken upon itself to provide only the most appropriate backup and replication to all its customers. With growing data usage and greater needs for retention of data, all the customers are looking for solutions which cater to each and every one of their need.

The Banking sector has evolved too and now requires services which are not limited to the traditional ways. StoneFly provides the banking sector with the services which ensure a connective workflow.

StoneFly provides banks with management of the data in the cloud. Banks do not have to rely on manual work done the traditional way anymore. The losses from errors are minimized resulting in effective and efficient work being done.

Compliance with the laws solves the legal issues of banks who are at a risk of not meeting certain legal obligations of storage. Storage provided by StoneFly is up to mark at fulfilling the legal requirements and alongside provides extra benefits in the form of legally maintaining records through cloud archive storage. Data can be stored and accessed at later points in time easily in minutes when the need arrives.

StoneFly protects data with end-to-end encryption which ensures that the data of users remains only in the hands of the users. Banks can be assured that the data of their users will be protected from all threats while maintaining total anonymity. The centralized management provided by StoneFly further ensures that only users have access to the data.

Scale-Out NAS is provided by StoneFly, so the banks can be at ease while accommodating to the growing number of users every day. Profitability of banks will increase with newer users and the costs per user will decrease as banks will be charged for only the amount of storage they use.

The foremost needs of banks are the requirements of applicable business recovery plans. Using the latest technology (like Erasure Coding) StoneFly makes sure that the downtime of businesses due to disasters decreases. Banks can recover from all sorts of disasters in a matter of minutes with the help of StoneFly with little or no loss to their precious data.

In this world of increasing financial services, StoneFly aims to provide the banking sector with technologically advanced services to ensure economic growth.